In this article, BeInCrypto takes a look at eight altcoins that decreased the most over the past seven days (March 12 – March 19).

This week’s Hateful 8 altcoins are:

- Theta Fuel (TFUEL) – 12.16%

- PancakeSwap (CAKE) – 9.83%

- Celsius (CEL) – 6.98%

- Near Protocol (NEAR) – 6.93%

- OKB (OKB) – 6.54%

- Solana (SOL) – 6.07%

- Elrond (EGLD) – 5.38%

- Voyager Token (VGX) – 5.18%

Theta Fuel (TFUEL)

THETA has been decreasing since an all-time high price of $0.459 was reached on March 12.

However, the decrease looked corrective due to frequent overlap.

TFUEL bounced on March 17 and broke out from a descending resistance line afterward.

Currently, it is approaching the 0.618 Fib retracement resistance at $0.397.

If it manages to clear it, the next resistance areas would be found at $0.46 and $0.557.

PancakeSwap (CAKE)

CAKE has been moving downwards since Feb. 19, when it reached a high of $21.45. While it bounced on Feb. 28, the increase resembles an A-B-C corrective structure.

Therefore, it is possible that CAKE has not yet reached a low. If so, it would find the next support area at $5.20

Celsius (CEL)

CEL has been moving downward since Jan. 3, when it reached an all-time high of $7.03.

It is currently trading inside a symmetrical triangle, which is considered a neutral pattern.

However, since the triangle is coming after an upward move, a breakout would be more likely.

If it breaks out, CEL could increase all the way to $9.29.

Near Protocol (NEAR)

NEAR has been increasing since it bounced on March 12. While the bounce has not been substantial, NEAR may have reversed its short-term bearish trend.

NEAR may be in the fifth and final sub-wave (orange) of a long-term wave three (white).

The most likely target for the top of the entire move is found near $10.40. The target is given by three different Fib retracement methods.

OKB (OKB)

OKB has been moving downwards since Feb. 22, when it reached a high of $23.80.

Currently, it is trading just above the 0.5 Fib retracement support at $14.30.

However, technical indicators in the daily time-frame are bearish. The RSI has fallen below 50, and the MACD has crossed into negative territory. Furthermore, the Stochastic oscillator has just made a bearish cross.

Therefore, while a short-term bounce could occur, OKB is likely to eventually drop towards the 0.618 Fib retracement support at $12.15.

Solana (SOL)

SOL has been decreasing since it reached an all-time high price of $18.20 on Feb. 24. While it bounced on Feb. 28, the upward movement looks corrective.

If the entire structure is a zig-zag A-B-C correction, SOL could complete one more downward movement towards $9.67. This would give waves A:C a 1:1 ratio.

Elrond (EGLD)

EGLD has been increasing since it bounced on Feb. 23. Throughout the increase, the MACD has turned bullish, and the RSI could soon break out above 50.

However, EGLD is still following a descending resistance line.

A breakout above this descending resistance line and reclaim of the $169 resistance area afterward would confirm that the trend is bullish.

If so, EGLD would likely reach a new all-time high price.

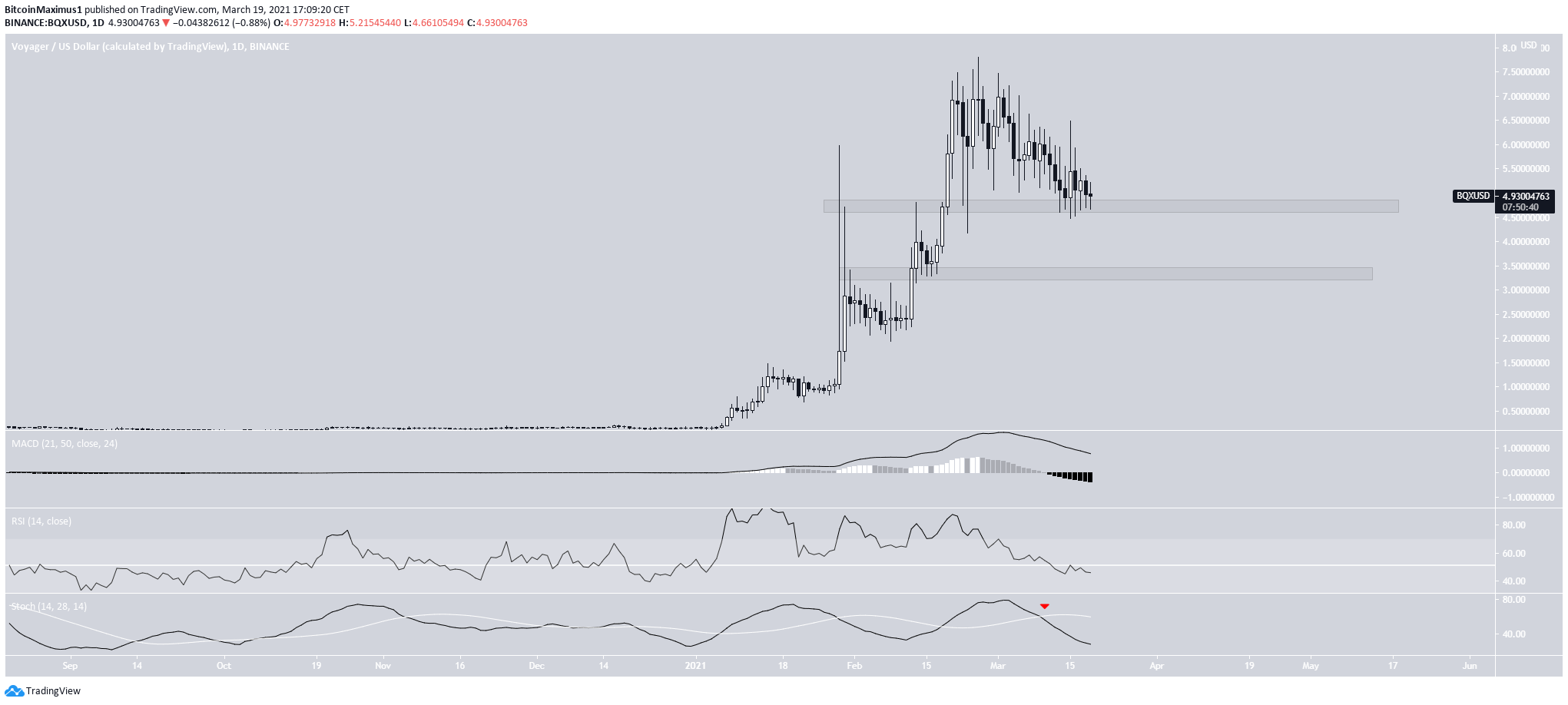

Voyager Token (VGX)

VGX has been decreasing since reaching an all-time high of $7.81. It did so on Feb. 25.

Currently, it is trading just above the $4.80 support area.

However, technical indicators in the daily time-frame are firmly bearish.

The future outlook seems similar to that of OKB.

While a short-term bounce is likely to occur, VGX is expected to break down afterward. If so, VGX would find the next support at $3.30.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.