The decentralized finance space has become increasingly crowded in recent months. New protocols, exchanges, and automated market makers are launching on an almost daily basis. One of the original protocols feeding many of those new ones, is Balancer, and it is still going strong.

The Ethereum based automated market maker allows users to create or add liquidity to customizable pools and earn trading fees. Balancer derives its name from the formula it uses. As such, it essentially allows any number of tokens in any weights or trading fees into to its custom pools.

The protocol is designed two categories of user:

- Liquidity providers who own Balancer pools or participate in shared pools.

- Traders who buy or sell the underlying pool assets on the open market.

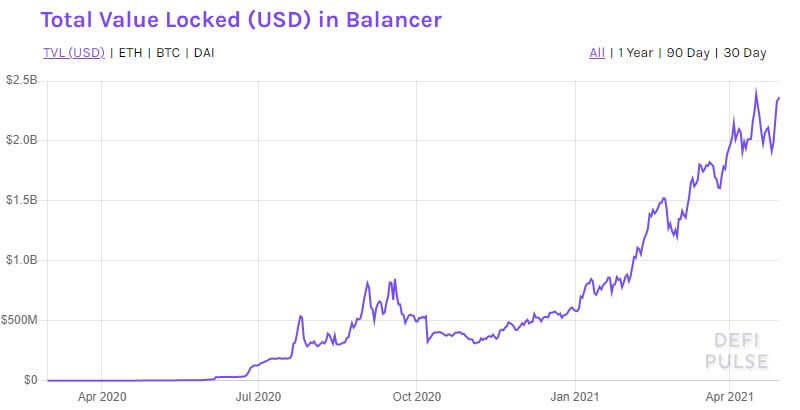

Over the past 12 months, the collateral locked into the platform has exploded from around $2.5 million to over $2 billion. This securely places Balancer in the top ten largest DeFi platforms on the planet.

In this DeFi Deep Dive, we will delve into the details to explain why Balancer has become so popular over the past year.

A brief history

Balancer has been in development since 2018 and was officially launched as a “bronze release,” the first of three planned releases in late February 2020. In its whitepaper, published in September 2019, Balancer describes the protocol as “a non-custodial portfolio manager, liquidity provider, and price sensor.”

The protocol has been developed by Balancer Labs, a technology firm founded by Fernando Martinelli and Mike McDonald. Balancer Labs is heavily venture capital-backed, having conducted several fundraising rounds over the past year generating $12 million in total investments. Most recently, in February 2021 when Three Arrows Capital and DeFiance Capital added their weight to the treasury.

In May 2020, Balancer began its own governance-driven liquidity mining program by allocating BAL tokens to liquidity providers. By late June, total value locked and token prices began to skyrocket in the wake of Compound Finance’s success as DeFi farmers jumped on the next big thing.

However, not all was smooth sailing for Balancer. The token came with accusations of big players gaming the system. Balancer pools were also targeted in a DeFi arbitrage attack in the same month, resulting in the loss of $500,000 in ethereum (ETH).

At the end of July, Balance governance approved the first liquidity mining proposals. As a result, the collateral started to flood in.

By the end of 2020, Balancer was one of the industry’s leading DeFi protocols with over $600 million in liquidity.

How does it work?

Balancer is essentially an advanced automated market maker. As a result, it uses the ratio between assets shared in liquidity pools to determine each asset’s value and keep them ‘balanced’.

As users add or remove liquidity from one side of a pool by conducting trades, this changes the pool ratio. Hence changing the value of each asset.

DeFiPulse describes the setup as similar to an inverse ETF:

“Instead of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders, who continuously rebalance your portfolio by following arbitrage opportunities.”

Anyone can create their own liquidity pool on Balancer and set its parameters. This including the trading fee and what assets they include in the pool. These multi-asset pools are their own crypto index funds, which are constantly in a state of automated rebalancing.

Traders can choose from a diverse set of pools. Each presents a unique set of investment opportunities and challenges through its particular configuration of tokens, weights, and fees.

The official documentation explains that the interplay between these settings, pool volumes, and external prices generates market forces that incentivize traders to maintain stable token ratios. Thereby preserving asset value for liquidity providers.

All pools in Balancer are also ERC-20 tokens known as Balancer Pool Tokens (BPTs), representing proportional ownership in the pool’s liquidity.

Balancer also offers a smart contract controlled pool called a Smart Pool which can fully emulate a finalized pool while also allowing complex logic to readjust balances, weights, and fees.

Balancer Tokenomics

Balancer has its own governance token, BAL. Users utlizie the token to vote on proposals and steer the direction of the protocol. Every week Balancer distributes 145,000 BAL tokens to liquidity providers, equating to approximately 7.5 million tokens per year.

The maximum supply of tokens is 100 million, and almost a third of those have already been dished out to early investors and the team. Founders, stock options, advisors, and investors, recieved 25 million BAL, subject to vesting periods. 5 million went into the Balancer Ecosystem Fund. Balancer allocated 5 million to a fundraising fund.

The project will distribute the remaining tokens to liquidity providers over the coming years. The protocol estimates at the current rate of 145K tokens per week will take 8.6 years to exhaust the supply.

In March 2020, Balancer Labs generated $3 million from a private seed round selling the tokens at $0.60. Those early investors will be in good shape today with current prices (late April 2021) at around $57 for one BAL token. The token hit an all-time high of $72 on April 15, 2021, and has made over 300% since the beginning of the year.

Enter Version 2

Balancer is ready to launch version 2 of the protocol which will bring in a raft of improvements. On April 20, Balancer Labs tweeted that the they released the smart contracts for v2 to mainnet but the full protocol launch had yet to occur at the time of writing.

As reported by BeInCrypto, Balancer unveiled the v2 specs in February 2021. According to the official announcement, the core tenets of Balancer v2 are security, flexibility, capital efficiency, and gas efficiency.

The new version will include something called a generalized automated market maker, which is essentially a transition to a single vault that holds and manages all the assets added by all Balancer pools. This effectively simplifies the protocol by creating a single access point for all interactions with Balancer v2. According to the explanatory blog post:

“Balancer V2 separates the Automated Market Maker (AMM) logic from the token management and accounting. Token management/accounting is done by the vault while the AMM logic is individual to each pool.”

The streamlining has been introduced to tackle the inefficiencies with multiple transfers for multiple tokens and pools. This ends up being very costly when Ethereum gas prices are at their peaks (which they have been for most of 2021).

The next iteration will also offer weighted pools. These are index fund-style pools, just like in version 1. In addition, it will introdice stable pools, with tokens that are soft pegged to each other.

Asset Managers will be another feature. These are external smart contracts nominated by pools to improve yields. Improvements in price oracles, pool restructuring fees, and new flash loan functionality will also ship with v2.

Balancer Labs also offered the biggest bug bounty in the industry’s history, with up to 1,000 ETH or $2 million for the discovery of critical bugs that allow attackers to drain the Balancer v2 vault.

At the time of writing, the v2 user interface launch was imminent but has yet to be officially announced.

Balancing the future of DeFi

Currently, Balancer’s total value locked was near its all-time high of $2.37 billion according to DeFiPulse. DappRadar had a similar figure.

Since the beginning of 2021, that collateral figure has surged by 300%, ranking the protocol as the tenth largest, just below Yearn Finance. According to Dune Analytics, Balance had around 140,000 users by the end of April.

In the same period, its BAL token price has made even greater gains with 330% from $13.60 on January 1 to $58.26 at the time of writing on April 29.

Overall, Balancer has come a long way over the past year. Its second iteration will likely dominate development efforts this year as new products focus on gas saving. The team does have bigger ambitions, however:

“This launch [v2] is a step towards Balancer’s larger vision to become the primary source of DeFi liquidity.”

Balancer is aiming to be a core building block for any and all DeFi projects, regardless of their design or liquidity needs.

Trusted

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.