The decentralized finance (DeFi) market is seeing heavy liquidation and decreased locked in value as the market corrects itself.

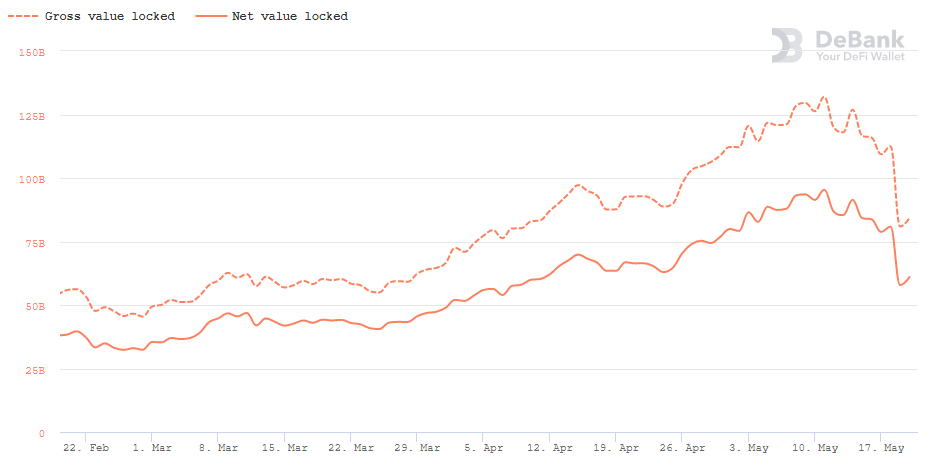

The DeFi market has taken a beating in the past 24 hours, with the total locked in value dropping by 39% from a peak on May 11. On that day, the total value locked in was approximately $131 billion, according to DeBank.

It’s now roughly $82.9 billion following a heavy correction that occurred on May 19.

Like almost every other asset and niche in the space, the DeFi market saw a multitude of liquidations. Despite this, many of the most well-known assets are still much higher than prices seen earlier in the year.

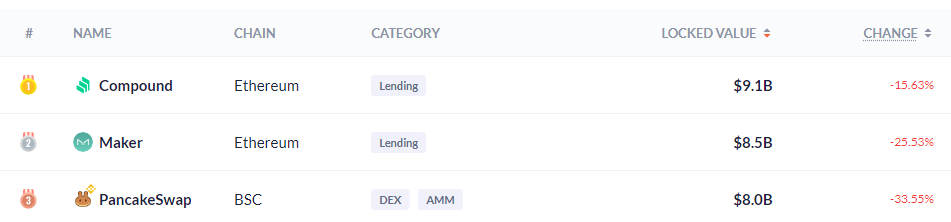

One of the hardest-hit platforms was PancakeSwap, which lost approximately 34% in gross value locked in the past 24 hours.

Of course, corrections are commonplace in any market. While the value locked and the prices of DeFi assets may be tumbling, it’s not necessarily true that this will last for long. DeFi is where savvy traders can make consistent gains from lending and liquidity programs, as has been the case in the past.

Several new protocols like Fantom and novel P2P lending solutions like Yield Credit show that there is much more innovation in the tank for DeFi. Gas fees, general scalability issues, and interoperability are still the key focus areas for many projects, and these may continue to help boost the market in the months to come.

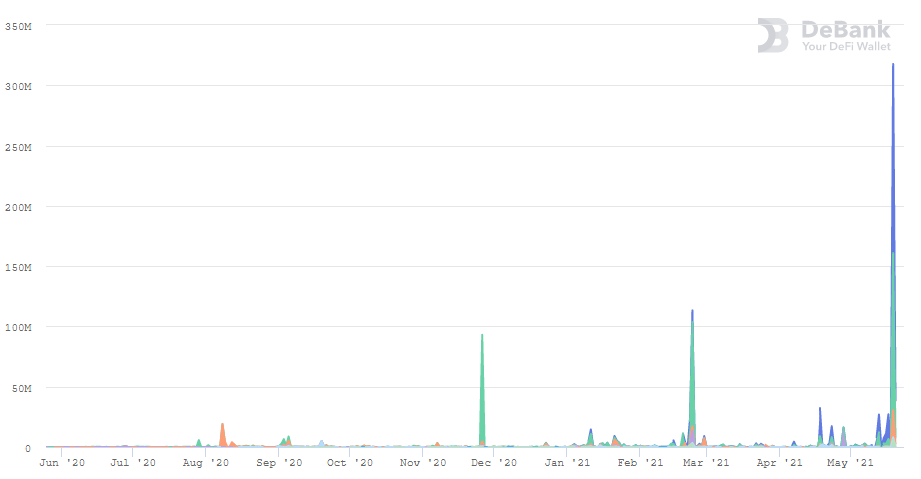

Ethereum DeFi loan clearing volume

On the subject of lending, Ethereum’s DeFi loan clearing volume exceeded $317 million on May 19, with the vast majority coming from Aave and Compound. These protocol’s 24-hour liquidation volumes stand at $167 million and $120 million respectively.

This is the highest it has ever been, with the previous high being $113 million in February 2021. These liquidation volumes offer a sense of just how impactful the current correction has been.

All in all, while the numbers may appear ominous, the DeFi market is likely to hold strong in the medium to long term. While non-fungible tokens (NFTs) may be hogging some of the spotlight, DeFi is a cornerstone of the market, which explains the heavy research and development pouring into it.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.