There has been negative sentiment in the cryptocurrency market for several months. Bears have dominated Bitcoin’s price action since at least the May 19 crash. Since then, however, the BTC price has been consolidating, and weakening volatility has provided a blue bottoming signal.

The recent visit of the Puell Multiple indicator to oversold territory coupled with negative funding rates in the futures markets and a negative premium on GBTC provides interesting data for interpretation. These indicators point to an upcoming big move in Bitcoin’s price. The question remains: will it be up or down?

Negative funding rates and premium

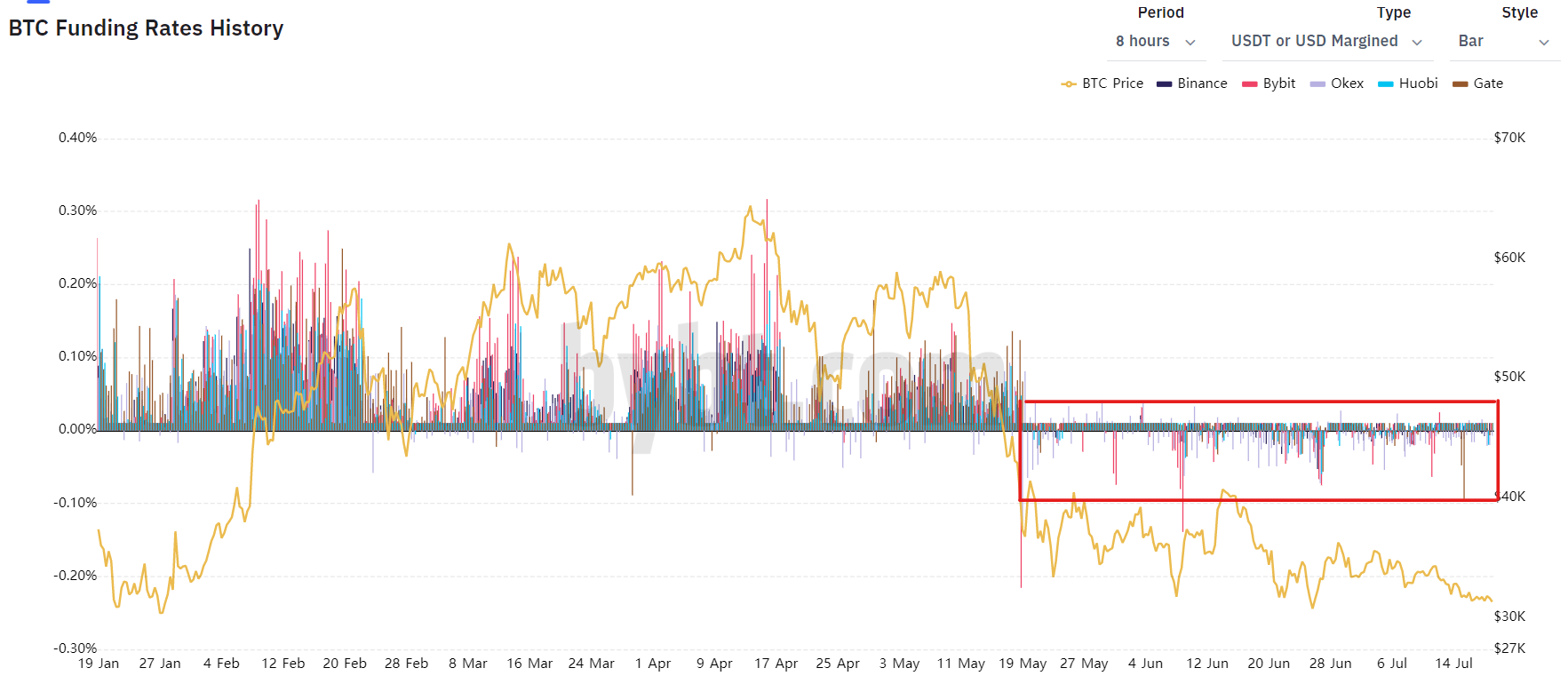

Since the monumental crash of 19 May 2021, when Bitcoin’s price bottomed at $30,000, funding rates on most cryptocurrency exchanges have turned negative. This means that traders in the futures markets must pay a premium to maintain their short positions throughout the ongoing May-July 2021 BTC consolidation period (red rectangle).

This situation means that most investors are expecting declines and market sentiment is bearish. On the other hand, it is also a hidden bullish signal, as it turns out to be more profitable to take a long position and gives exchanges and whales the opportunity to set a bear trap.

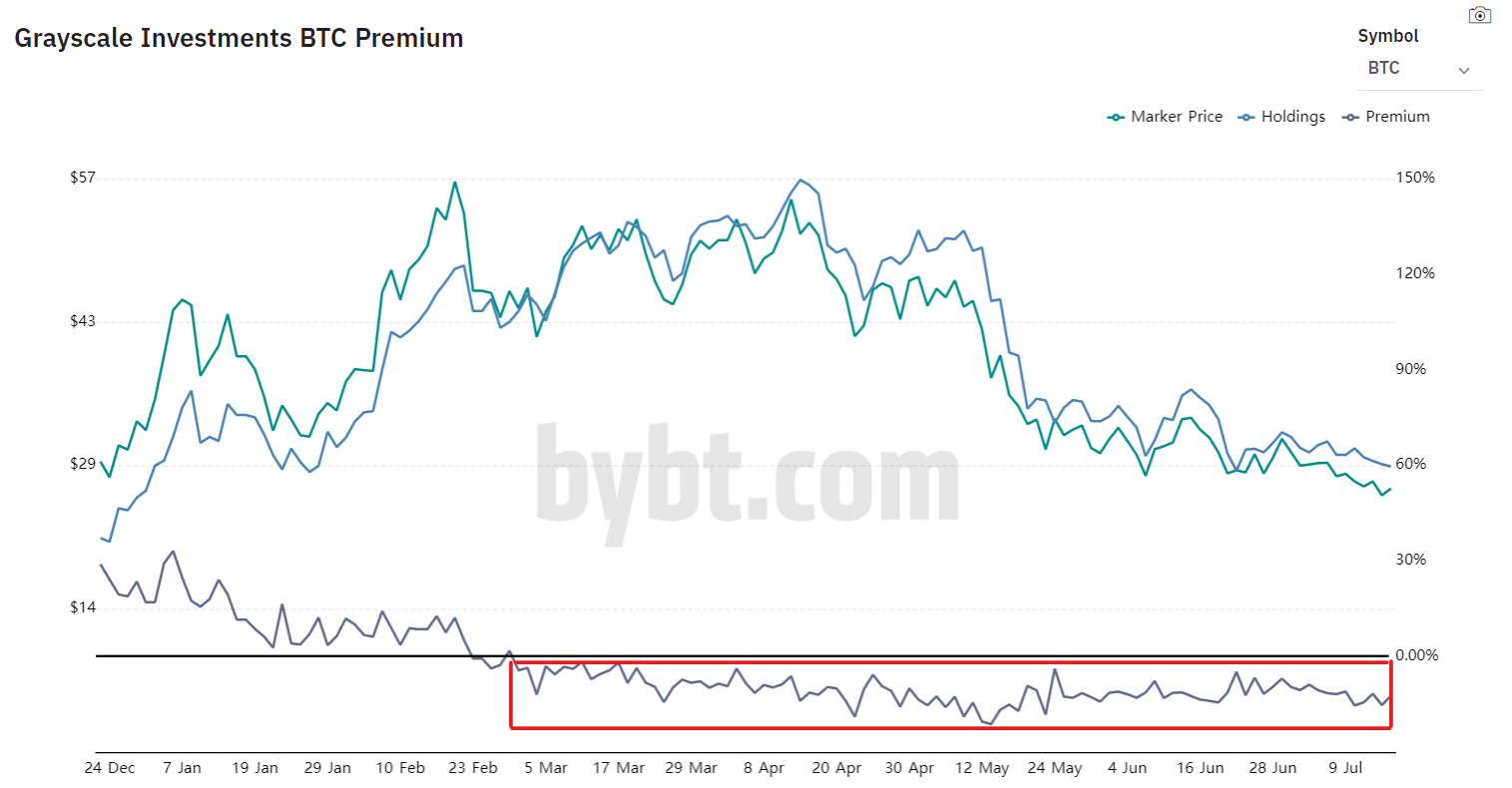

We see a similar situation on the premium indicator for the Grayscale Bitcoin Trust (GBTC). Premium is the difference in the valuation of an asset in a given fund and the market price.

From the beginning of GBTC, the premium remained positive and investors were willing to pay more for an asset purchased through the fund as they believed it would increase over time.

However, since the beginning of March 2021, we see the opposite development. Premium has fallen below the 0% line (black) and has remained negative for 5 months (red rectangle).

Bullish signals?

However, despite the negative funding rates and premium on GBTC, some analysts see bullish signals here. In today’s tweet, long-term investor and analyst @CryptoCapo said that the continuation of negative values of these indicators during Bitcoin’s current price range is another reason for bullish expectations.

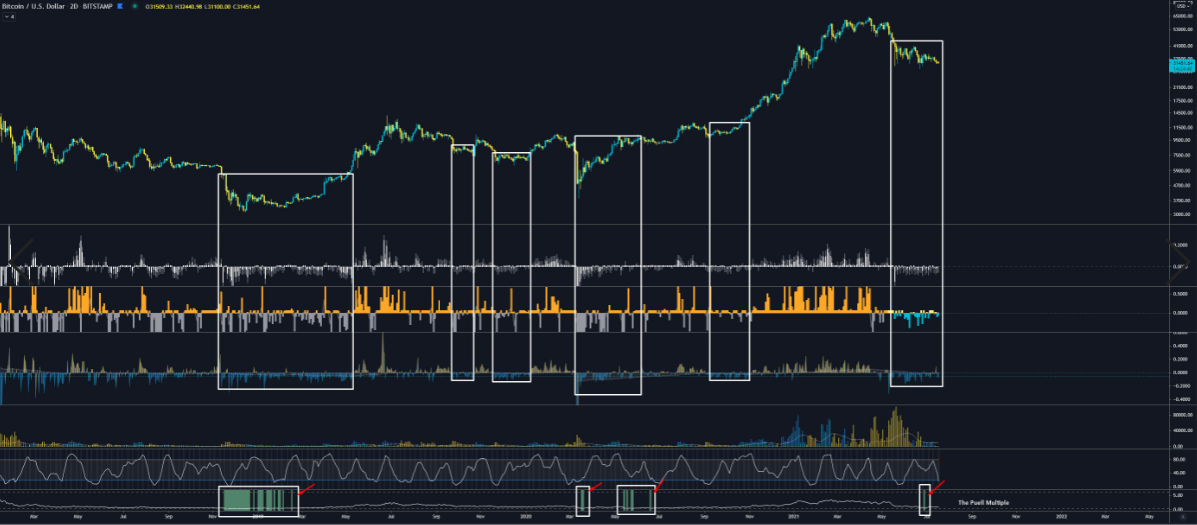

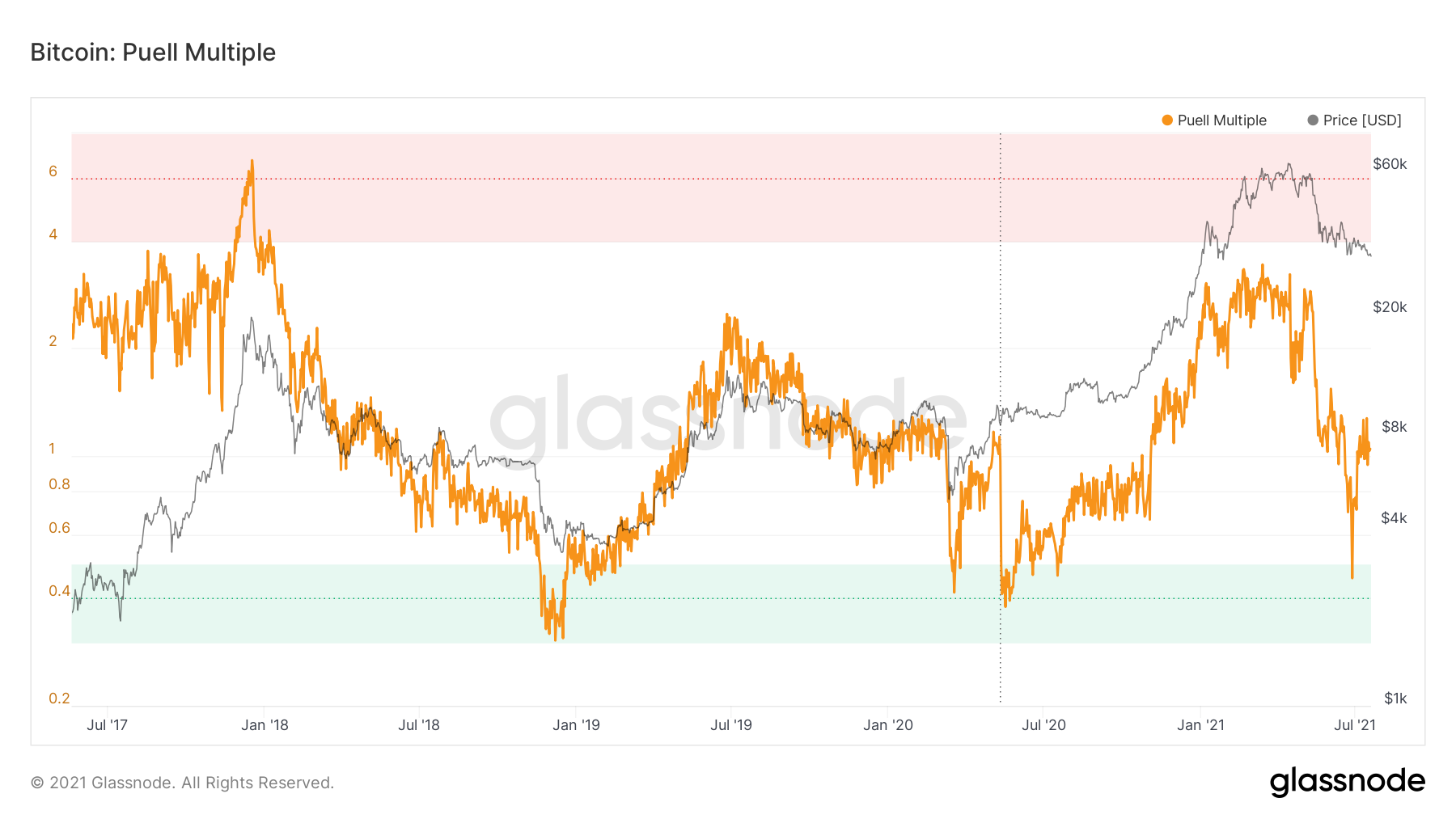

Moreover, the analyst linked these indicators to the bullish reading provided by Puell Multiple. As recently reported by BeInCrypto, this indicator touched the oversold area (green), where it has been only a few times during the entire history of Bitcoin prices.

BTC volatility turns blue

The cryptocurrency asset class is characterized – by its nature and young age – by a high volatility. Nevertheless, also in this market, from time to time we see periods of very low volatility that result in relative price stability.

One of the best indicators of Bitcoin’s volatility is the BBWP (Bollinger Band Width Percentile), which measures the percentage of Bollinger bands moving away. The last time this indicator turned blue and signaled minimal volatility, Bitcoin was in the $8800 – $9800 range for over a month, in June-July 2020 (green rectangle).

Today, with the BTC price in the $30,000 – $34,000 range, volatility is once again bottoming out. This potentially suggests that a sharp move in the largest cryptocurrency is imminent. However, the direction of this movement is not determined by the volatility indicator itself.

Conclusion

Negative funding rates and premium indicate a generally bearish sentiment in the cryptocurrency market. However, historical data shows that these were the best opportunities to buy Bitcoin at a discounted price. Sentiment can change overnight.

The recent visit to the oversold area of the Puell Multiple indicator and the upcoming big move in BTC volatility could be signals of a reached or impending long-term bottom in the crypto market.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.