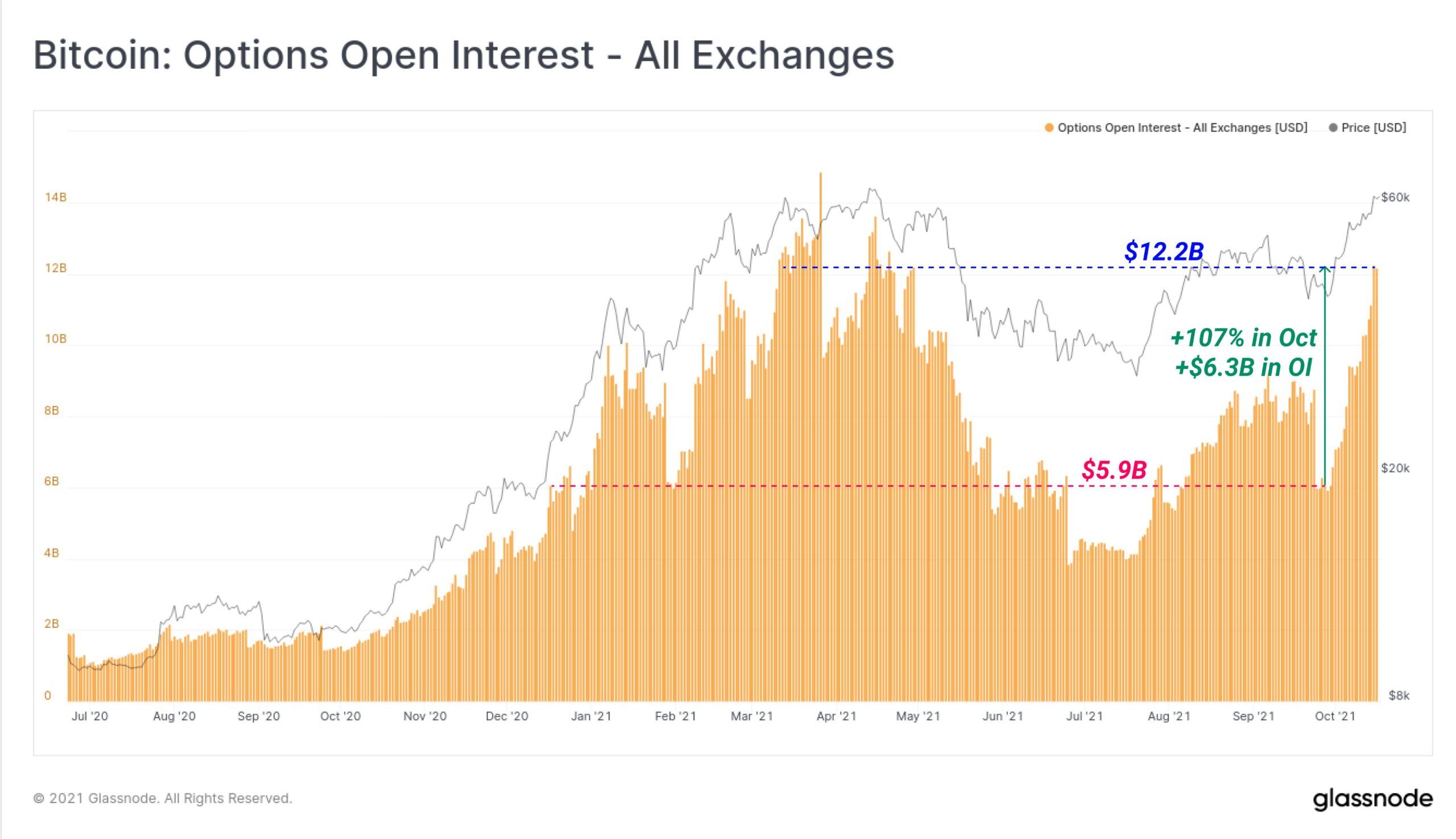

As Bitcoin prices approach their highest-ever prices, derivatives metrics are starting to show ominous signs which could result in a sizeable correction. According to on-chain analytics provider Glassnode, options open interest (OI) has exploded in October. Options allow traders to buy Bitcoin contracts with the option of selling them before the allotted date or price, unlike futures contracts which are fixed.

Open interest refers to the total number of outstanding derivative contracts that have not been settled. The higher it is, the more market participants there are watching things closely and waiting for the trend to change.

Bitcoin OI doubles in a month

Open interest is currently up 107% or $6.3 billion since the September lows as more money has flowed into Bitcoin derivatives products.

Glassnode added that Bitcoin options volume is also elevated, peaking at $1.5 billion per day last week, stating that the last time option trade volume was this high was on three occasions between March and May of this year.

It added that BTC bulls favor strike prices above $100,000, “giving insight into an overall positive market sentiment.”

Leverage warning signs

Derivatives exchanges also offer highly leveraged positions to traders which can be a red flag for markets. When the contracts are liquidated, they can cause a cascade effect which increases selling pressure and can result in a market crash.

This has been seen several times before in the current market cycle with over-leveraged positions being flushed out in one swoop. Computer scientist and partner at Cinneamhain Ventures, Adam Cochran, commented on the amount of leverage in markets at the moment,

“Not loving how stupid leverage is looking going in to the open tomorrow. OI on Bitcoin is up around the same levels we were when we had the big crash. Lots of leverage in the system right now.”

In late February, Bitcoin crashed 22% in a matter of days due to the flushing out of over-leveraged positions. A similar crash occurred in mid-April when BTC slumped 24% in a few days, and it happened again in early September with a 15% wipeout. Signals are indicating that the same could be about to happen again.

A leverage-induced crash from current prices could drop BTC back below $50,000 in a matter of days. Analysts are advising caution as liquidating leverage is a natural part of market action, and prices rarely go up parabolically and stay there for long.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.